Calculate social security wages on w2

Taxpayer W2 wages from business activity Enter the W-2 wages paid to S-Corp or C Corp owners of the business activity. Paycheck stubs help to reconcile the form W-2 and social security contributions.

So You Have Stock Compensation And Your Form W 2 Just Arrived Now What The Mystockoptions Blog

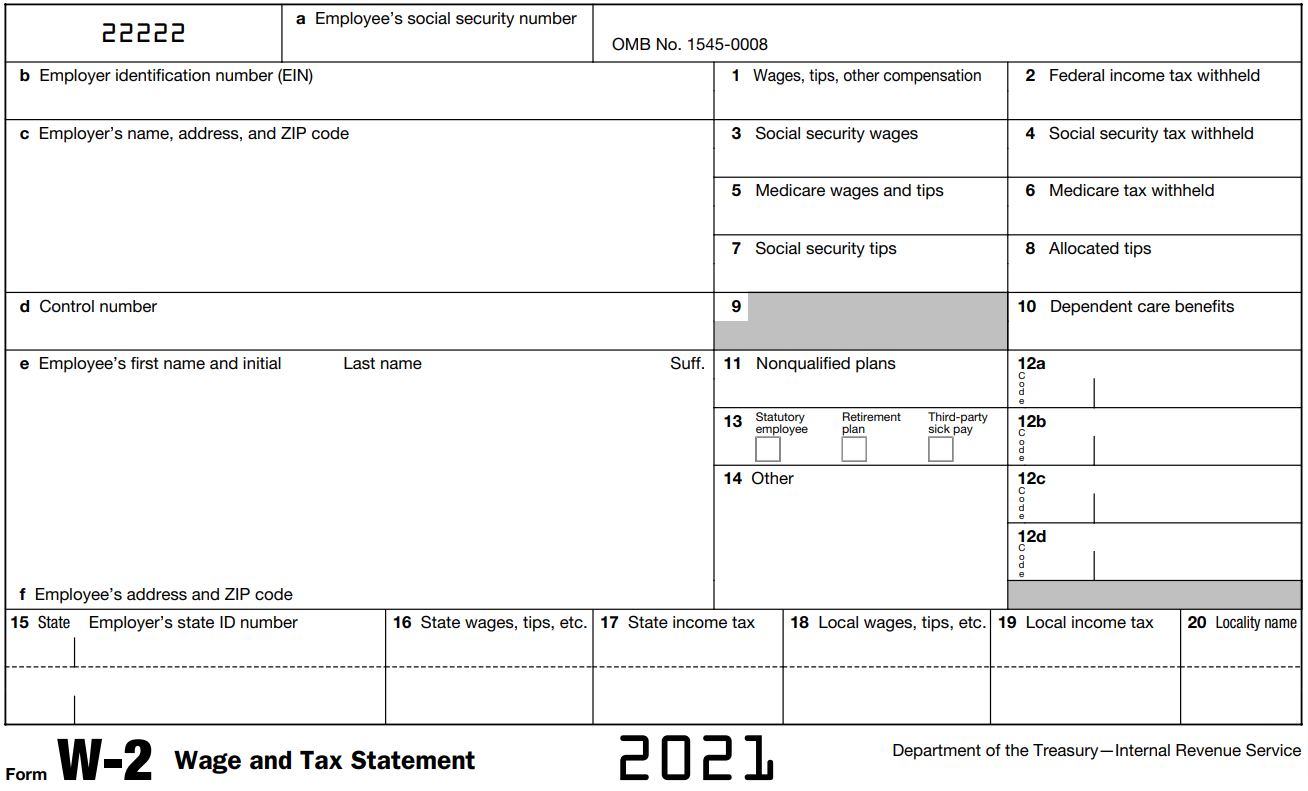

The W-2 form reports an employees annual wages and the.

. Your taxable wages for those two taxes might be the same or they might differ because Social Security has an annual wage limit and Medicare has none. Each year the Internal Revenue Service sets a maximum amount of income that is. 2000 500 15 - 15 2500 When it is time to calculate how much employer and employee Social Security taxes to withhold from Simone 2500 is the wage amount used.

Heres how you would calculate her Social Security wages. As a matter of fact the Social Security Administration SSA actually prefers online W2 forms to be filed as. Calculate the Social Security portion of self-employment tax.

Including year-end W2 and 1099. However in 2021 this changed to Medicare taxes. Calculate the social security and Medicare tax owed on the allocated tips shown on your Forms W-2 that you must report as income and on other tips.

An individual can apply for a social security number if the individual has been lawfully admitted to the US. Box 3 on the W-2 form shows the total wages an employee received that are subject to the Social Security tax. The change will only apply to wages paid after June 30 2021.

When all else fails or its taking too long to retrieve your lost W2 using a w2 generator is your best bet. If you have any questions about your social security wages or FICA taxes be sure to Dana M. Both Social Security and Medicare are withheld in this way.

There are two components of social security taxes. What Are Social Security Wages. Having business pay stubs helps individuals verify that their gross wages withholdings deductions are accurate.

The Ascent goes through how to calculate taxed wages in this guide. This income is taxable for Federal and State as well as Social. An applicant should file Form SS- 5 with the Social Security Administration.

Use a W2 Generator. Calculate the Medicare portion of self-employment tax. If a minimum wage was placed equal to W1 it would increase employment to Q1.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. To calculate your total salary obtain your taxable wages from either Box 3 or Box 5 and add the amount to your nontaxable wages and pretax deductions which are excluded from FICA taxes. FICA in addition to Federal and State taxes.

Learn more about how to calculate your W2 wages easily. This aims to make sure that the correct amount is. In 2020 the ERTC was claimed against the Social Security Taxes.

First you calculate the difference in hourly rate which in this example is three dollars per hour. In the event that the W2 form was late or misplaced a paystub can be used in its place to calculate the needed data. The 22 flat rate could result in too little being withheld for taxes depending on your tax bracket.

Only part of your earnings is subject to Social Security which for 2020 is the first 137700 of earnings. By filing Form 4137 your social security tips will be credited to your social security record used to figure your. A monopsony pays a wage of W2 and employs Q2.

Social security tax withheld. If the credit exceeds your total liability of the social security or Medicare taxes it will be treated as an overpayment and you will get a refund. Employees will need their paystub documents for various reasons.

A Company Pay Stub For Taxes. Social Security Number. The National minimum wage has risen faster than average wages especially since 2007.

Use your last pay stub for the year to calculate the taxable wages in boxes 1 and 16 in your W-2. Get 247 customer support help when you place a homework help service order with us. W-2 wages may be used to calculate the Sec 199Ab2 limitations.

Add GTL imputed income from Box 12C on your W2 The resulting amount should equal Box 3 Social Security Wages and Box 5 Medicare Wages on your W-2. Social Security Wage Base - 2018. Once supplemental wages for the year exceed 1 million employers withhold at a flat rate of 37.

Employers withhold at a flat rate of 22 on the first 1 million of supplemental wages paid out during the calendar year. The W-2 form is the form that an employer must send to an employee and the Internal Revenue Service IRS at the end of the year. Calculate Social Security Taxes.

For permanent residence or has an immigration visa that authorizes the individual to work in the US. Income includes your traditional salary and wages which are reported on Form W-2 any earnings from self-employment ventures and any other income reported on 1099 forms like investment. Since October 2010 the National Minimum Wage has increased from 593 to 872 2020 while average wages have stagnated.

The Social Security wages in box 3 are capped by the annual limit for the Social Security tax which equals 132900 as of 2019 but adjusts annually for inflation. HI calculations are unaffected since they are not subject to a wage cap. Calculate your state income tax step by step 6.

If you want to simplify payroll tax calculations you can download ezPaycheck payroll software which can calculate federal tax state tax Medicare tax Social Security Tax and other taxes for you automatically. Social Security Taxes are based on employee wages. Some being proof of income income verification as well as tax filing.

A W-2 form can be used to calculate the necessary information. Ronalds team at Tax Crisis Institute in California or Nevada. There is no limit for the.

You can try it free for 30 days with no obligation and no credt card needed. On Form 4137 you will calculate the social security and Medicare tax owed on the allocated tips shown on your Forms W-2 that you must report as income and on other tips you did not report to your employer. This information is also used to calculate the amount of the fringe benefit to the included in the employees W-2 income.

Medicare wages and tips. If the raise took effect with four days to go in the pay period that means four days of pay using eight hours per day based on a 40-hour workweek need to be accounted. Social Security Wages are withheld by your employer to pay the IRS.

Amount added to Taxable Wages on W2 _____ These wages are subject to Social Security Medicare taxes. Solve the lost W2 issue with a W2 maker. Non-owner W2 wages.

FICA taxes in the event that the total of all W2 earning from multiple employers for the year 2022 exceed 113700. An example of a tax that caps the amount taken out of an employees pay is Social. Then you calculate how many hours were incorrectly paid at the old rate.

Begin with the Gross Pay YTD year-to-date and make the following adjustments if applicable.

Understanding Your Forms W 2 Wage Tax Statement Tax Forms W2 Forms Power Of Attorney Form

Form W 2 Explained William Mary

How To Read A Form W 2

Pin On Starting A Business Side Hustles After Divorce

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

W2 Tax Document Business Template Tax Bill Template

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

Understanding Your W 2 Controller S Office

Pin By Connor Quigley On Connor S Tax Board Irs Tax Forms Social Security Internal Revenue Service

How To Fill Out A W 2 Tax Form For Employees Smartasset

Two Websites To Get Your W2 Form Online Online Taxes Filing Taxes W2 Forms

Fillable Form W 2 Or Wage And Tax Statement Edit Sign Download In Pdf Pdfrun Tax Forms Internal Revenue Service Fillable Forms

Irs Form W 2 Guide Understand How To Fill Out A W 2 Form Ageras

How To Calculate Agi From W 2 Tax Prep Checklist Income Tax Return Tax Deductions

Understanding Your Irs Form W 2

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center