Tax amount calculator

40680 26 of taxable income. Use this calculator to find out the amount of tax that applies to sales in Canada.

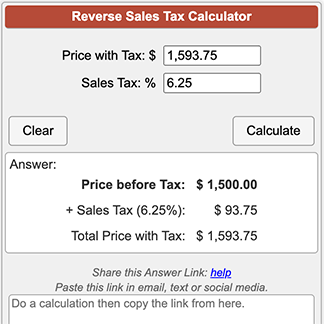

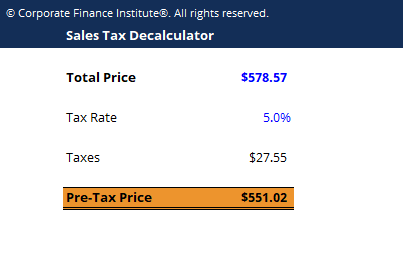

Reverse Sales Tax Calculator

New York state tax 3925.

. How much Australian income tax you should be paying what your. Between 50271 and 150000 youll pay at 40 known as the higher rate and above. Use our employees tax calculator to work.

GSTHST provincial rates table The following table provides the GST and HST provincial rates. Tax returns may be e-filed without. The calculator will calculate tax on your taxable income only.

2023 tax year 1 March 2022 - 28 February 2023 Taxable income R Rates of tax R 1 - 226000. Simple tax calculator This calculator helps you to calculate the tax you owe on your taxable income for the full income year. Marginal tax rate 633.

An income tax calculator is a tool that will help calculate taxes one is liable to pay under the old and new tax regimes. Federal Income Tax Return Calculator Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. Income tax calculator How much Australian income tax should you be paying.

18 of taxable income. On income between 12571 and 50270 youll pay income tax at 20 - known as the basic rate. Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax.

Total income tax -12312. Assessment Year Tax Payer Male Female. If approved funds will be loaded on a prepaid card and the loan amount will be deducted from your tax refund reducing the amount paid directly to you.

Estimate your Income Tax for the current year Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2022. Income Tax Department Tax Tools Tax Calculator As amended upto Finance Act 2022 Tax Calculator Click here to view relevant Act Rule. When youre done click on the Calculate button and the table on the right will display the information you requested from the tax calculator.

Estimate your US federal income tax for 2021 2020 2019 2018 2017 2016 2015 or 2014 using IRS formulas. Youll be able to see the gross salary. It can be used for the 201314 to 202122 income years.

The calculator uses necessary basic information like annual salary rent. Use our employees tax calculator to work out how much PAYE and UIF tax you will pay SARS this year along with your taxable income and tax rates. 1 minutes On this page Helps you work out.

Income Liable to Tax at Normal Rate --- Short Term Capital Gains Covered us 111A 15 Long Term Capital Gains Covered us 112A 10. 2022 free Canada income tax calculator to quickly estimate your provincial taxes. Effective tax rate 561.

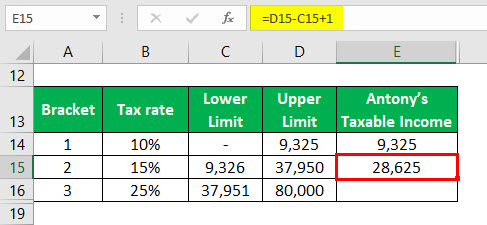

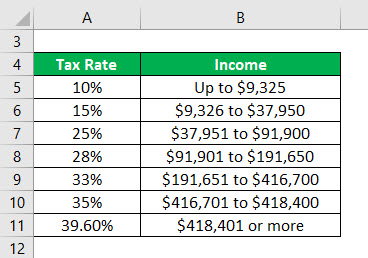

Excel Formula Income Tax Bracket Calculation Exceljet

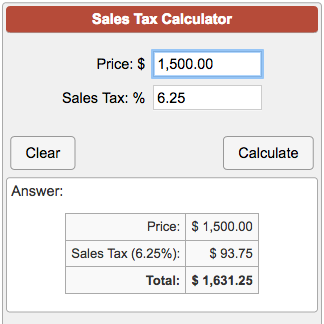

Sales Tax Calculator

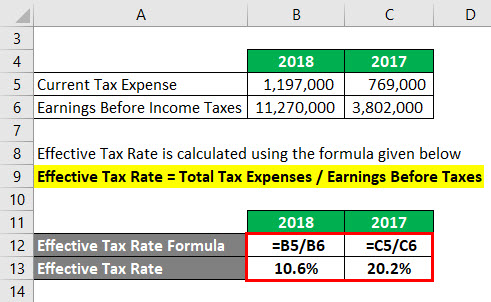

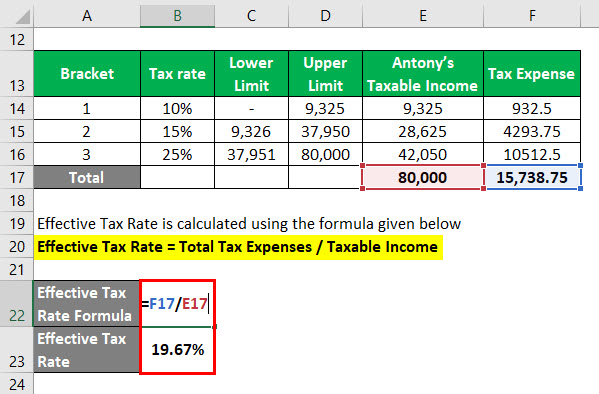

Effective Tax Rate Formula Calculator Excel Template

Effective Tax Rate Formula Calculator Excel Template

Effective Tax Rate Formula Calculator Excel Template

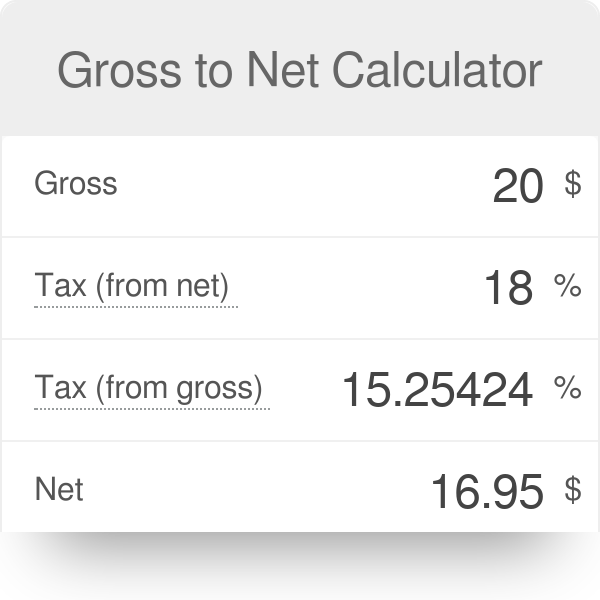

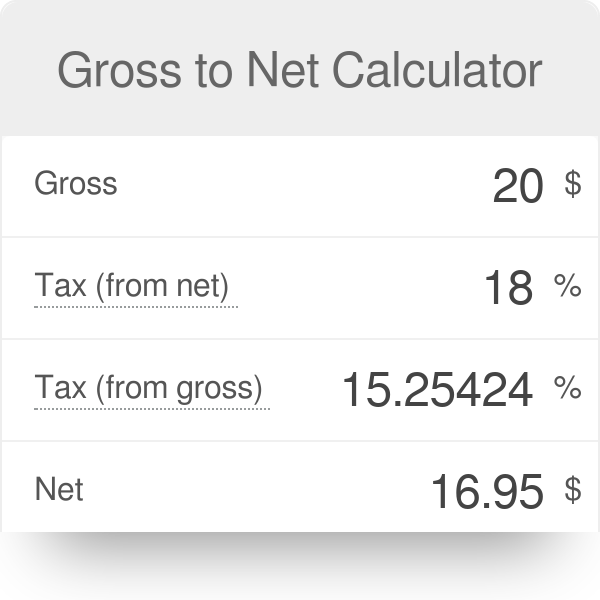

Gross To Net Calculator

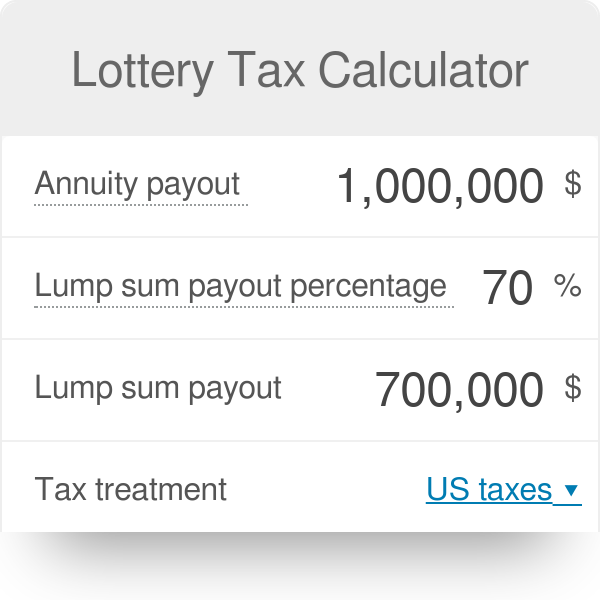

Lottery Tax Calculator

How To Calculate Income Tax In Excel

Effective Tax Rate Formula Calculator Excel Template

Effective Tax Rate Formula Calculator Excel Template

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Property Tax Calculator

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

Sales Tax Calculator

Sales Tax Calculator

How To Calculate Federal Income Tax

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor